Whether or not you’re a economic advisor, investment issuer, or other financial Experienced, discover how SDIRAs may become a strong asset to grow your business and accomplish your Specialist plans.

In the event you’re searching for a ‘established and forget about’ investing method, an SDIRA most likely isn’t the right preference. Simply because you are in complete control about each and every investment made, It can be up to you to perform your own private due diligence. Try to remember, SDIRA custodians will not be fiduciaries and cannot make suggestions about investments.

Greater Expenses: SDIRAs frequently include better administrative fees compared to other IRAs, as specific areas of the executive process cannot be automated.

And since some SDIRAs for instance self-directed common IRAs are issue to needed minimum amount distributions (RMDs), you’ll must plan forward to make certain you may have enough liquidity to fulfill The principles established because of the IRS.

Being an Trader, nevertheless, your options will not be restricted to shares and bonds if you end up picking to self-immediate your retirement accounts. That’s why an SDIRA can rework your portfolio.

Have the freedom to invest in almost any sort of asset that has a possibility profile that fits your investment strategy; including assets which have the prospective for a higher level of return.

Building probably the most of tax-advantaged accounts lets you retain additional of the money you make investments and make. According to no matter if you decide on a conventional self-directed IRA or possibly a self-directed Roth IRA, you might have the opportunity for tax-free or tax-deferred advancement, delivered sure disorders are fulfilled.

This involves understanding IRS restrictions, handling investments, and staying away from prohibited transactions which could disqualify your IRA. An absence of information could end in pricey issues.

No, you cannot put money into your own private enterprise that has a self-directed IRA. The IRS prohibits any transactions between your IRA as well as your possess business enterprise because you, because the proprietor, are regarded a disqualified particular person.

An SDIRA custodian is different as they have the right team, experience, and capability to maintain custody on the alternative investments. Step one in opening a self-directed IRA is to locate a service provider that is specialized in administering accounts for alternative investments.

Restricted Liquidity: Many of the alternative assets which might be held in an SDIRA, including real estate, non-public equity, or precious metals, is probably not quickly liquidated. This can be a difficulty if you must access cash swiftly.

Higher investment solutions signifies you are able to diversify your portfolio further than stocks, bonds, and mutual cash and hedge your portfolio against current market fluctuations and read this volatility.

A lot of investors are stunned to learn that working with retirement funds to take a position in alternative assets has been attainable because 1974. On the other hand, most brokerage firms and banks target giving publicly traded securities, like shares and bonds, because they lack the infrastructure and expertise to manage privately held assets, such as housing or non-public equity.

Be accountable for how you grow your retirement portfolio by utilizing your specialized information and interests to speculate in assets that in shape using your values. Received expertise in housing or personal fairness? Utilize it to assistance your retirement planning.

Complexity and Obligation: With the SDIRA, you may have more Manage around your investments, but Additionally you bear much more responsibility.

SDIRAs are frequently used by hands-on investors that are willing to tackle the dangers and tasks of selecting and vetting their investments. Self directed IRA accounts will also be great for buyers who may have see this here specialised know-how in a niche market they would like to put have a peek at this site money into.

Research: It's named "self-directed" for just a cause. By having an SDIRA, you are totally chargeable for completely exploring and vetting investments.

Entrust can help you in buying alternative investments together with your retirement funds, and administer the buying and advertising of assets that are usually unavailable by way of banking institutions and brokerage firms.

Property is among the most well-liked options among the SDIRA holders. That’s mainly because you'll be able to put money into any sort of real-estate having a self-directed IRA.

Tia Carrere Then & Now!

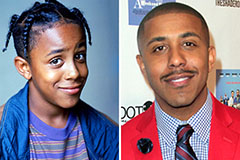

Tia Carrere Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Shane West Then & Now!

Shane West Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!